Financial Planning for Airbnb Hosts | Boost Airbnb Profits now

Financial Planning for Airbnb Hosts | Boost Airbnb Profits now

agency.zela@gmail.com

Why Financial Planning is Essential for Airbnb Hosts

Running a successful Airbnb business requires more than a stunning property and great reviews—it demands smart financial planning. Without a solid financial strategy, even the most booked listings can struggle to stay profitable. In this guide, we explore actionable financial planning strategies for Airbnb hosts to reduce risk, boost profitability, and grow a resilient short-term rental business.

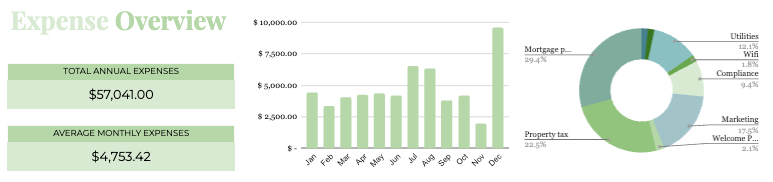

Step 1: Understand Your Fixed and Variable Costs

Before setting pricing or goals, get clear on your expenses. Accurate budgeting is the foundation of any successful financial plan.

Fixed Costs

- Mortgage or rent

- Insurance

- Property taxes

- Licensing fees

- Cleaning services (if on contract)

Variable Costs

- Utilities

- Maintenance and repairs

- Consumables (toiletries, coffee, snacks)

- Restocking supplies

- Seasonal upgrades (e.g. heaters or fans)

💡 Tip: Use an Airbnb expense tracker or financial planning template to monitor monthly outflows easily.

Step 2: Set Income Goals Based on Realistic Projections

Understanding your revenue potential sets the stage for strategic growth.

How to Calculate:

- Estimate occupancy rate based on historical data or tools like AirDNA.

- Multiply by your average nightly rate (considering seasonal changes).

- Subtract monthly costs from projected revenue.

Example:

Occupancy: 70% | Nightly Rate: $180 | 30 Days → $3,780 Revenue

Expenses: $1,200 → $2,580 Net Profit

Step 3: Use Dynamic Pricing to Optimize Revenue

Static pricing leaves money on the table. Dynamic pricing adjusts your nightly rates based on market demand, local events, and competitor pricing.

Tools to Use:

- PriceLabs

- Beyond Pricing

- Wheelhouse

These tools help you avoid underpricing during peak demand and overpricing in low seasons.

📌 Related post: Airbnb Dynamic Pricing Strategies – Learn more about choosing the right pricing tool and maximising nightly revenue.

Step 4: Save for Maintenance, Taxes, and Emergencies

Surprises happen. Plan for them.

Recommended Strategy:

- Save 5–15% of monthly revenue for repairs and replacements (depending on house type, age, climate, location etc.)

- Set aside a tax reserve based on your location’s short-term rental laws.

- Build an emergency fund for low seasons or cancellations.

Step 5: Track Your Performance with Monthly Reviews

Reviewing your financials monthly keeps your business on track and allows you to adapt quickly.

What to Track:

- Occupancy rate

- Revenue per available night (RevPAN)

- Average nightly rate (ADR)

- Guest acquisition cost (ads, OTA fees)

📊 Use financial dashboards or a custom Airbnb spreadsheet to visualize your data and make smarter decisions.

Step 6: Separate Personal and Business Finances

Avoid confusion by creating a dedicated bank account and credit card for your Airbnb income and expenses. This simplifies accounting, especially during tax season, and provides clear insights into profitability.

💡 Tip: Use accounting software like QuickBooks or Wave to categorize transactions automatically.

Step 7: Hire Professionals When It Makes Sense

If you’re managing multiple properties or scaling, working with experts can streamline your business.

- Accountants: Help with tax deductions and reporting.

- Financial advisors: Offer long-term investment advice.

- Property managers: Handle logistics so you can focus on strategy.

Step 8: Plan for Growth and Investment

Once your Airbnb is profitable, consider reinvesting in:

- Property upgrades to raise your nightly rate

- A second or third property

- Digital marketing to attract more direct bookings

🎯 Having a clear reinvestment plan ensures your business doesn’t stagnate and helps you scale sustainably.

Bonus: Tools and Templates for Financial Planning for Airbnb Hosts

Here are a few resources to streamline your finances:

Conclusion: Build a Financially Resilient Airbnb Business

Smart financial planning for Airbnb hosts isn’t optional—it’s essential for long-term success. By mastering your numbers, planning for the future, and investing strategically, you turn your short-term rental into a sustainable business.

📥 Ready to Take Control of Your Airbnb Finances?

Download our Airbnb Financial Planning Template to organise your income, expenses, and projections like a pro.

Or, partner with Zela Agency for expert help in scaling your Airbnb brand with data-driven marketing and growth strategies.